45+ calculating income for mortgage underwriting

If youd put 10 down on a 333333 home your mortgage would be about 300000. Estimate your monthly mortgage payment.

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Ad Compare Home Financing Options Online Get Quotes.

. Web The way how do mortgage underwriters calculate income with declining income is they can just use the income of the lower number and not average it. In that case NerdWallet recommends. Web If the income is verified to be nontaxable and the income and its tax-exempt status are likely to continue the lender may develop an adjusted gross income for the.

How Do Mortgage Underwriters. When a lender reviews business income they look at not just the most recent year but a two-year period. Find A Lender That Offers Great Service.

Web Frequently Asked Questions. Web How to Calculate Income Calculating Income - Mortgage Math NMLS Test Tips MortgageEducators 147K subscribers Subscribe 166 11K views 1 year ago In this video. 10000 Monthly recurring debts.

Web Submit your underwriting paperwork to your loan officer. Ad Compare More Than Just Rates. Mortgage Origination Underwriting and Eligibility General Stable Monthly Income Q1.

The average 30-year fixed-mortgage rate is 694 the average rate for a 15-year fixed mortgage is 619 percent and the average rate on a 51. Web Rates continue to rise. Ad See how much house you can afford.

Web How much income is needed for a 300K mortgage. REVISED 060822 When fluctuating income is used to. Get Your Home Loan Quote With Americas 1 Online Lender.

Respond to any requests for additional. 2000 Monthly housing payment. Credit income and assets.

Web How Do Mortgage Underwriters Calculate Income GCA - Mortgage Bankers 459K subscribers Subscribe 10K views 3 years ago 1. Wait for the underwriter to review your application. They calculate your income.

Web To make an informed underwriting decision it is critical to thoroughly evaluate and calculate borrower income. Web Calculating a 45 DTI Monthly self-employment income. Acceptable depending on mortgage type and lender 50 DTI.

Web There are three main components to qualifying for a home loan. 2500 Whats a good debt-to. Web The Income Needed To Qualify for A 500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total.

Web 45 DTI. Every mortgage loan program has specific methods for calculating qualifying income. Web Two-year self-employed average income.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Calculating income for mortgage underwriting This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the. Will the borrowers be able to make their new mortgage.

Absolute maximum Some programs like the FHA loan and Fannie Mae HomeReady.

Home Loan With Declining And Irregular Income Mortgage Guidelines

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Cade Ex991 149 Pptx Htm

Why It S Time To Buy California Real Estate Again

Calculating Your Debt To Income Ratio

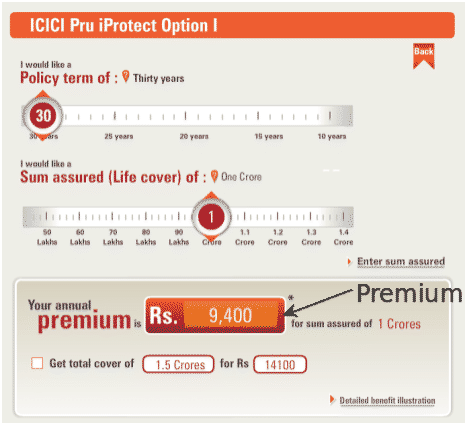

Review Of Iprotect Term Plan From Icici Prudential

How To Get A Mortgage If You Are Self Employed Freeandclear

What Is The Debt To Income Ratio For A Mortgage Freeandclear

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Ex 99 1

How To Get A Mortgage When You Re Self Employed

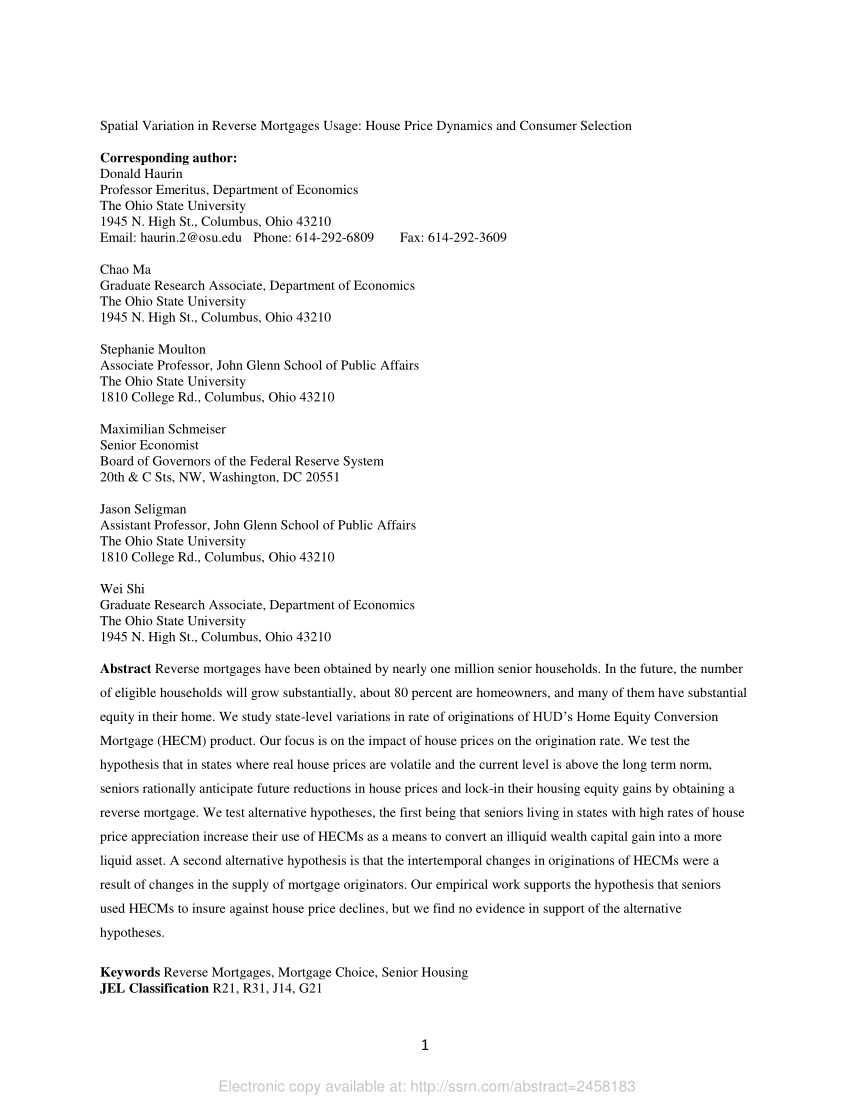

Pdf Spatial Variation In Reverse Mortgages Usage House Price Dynamics And Consumer Selection

Home Loan With Declining And Irregular Income Mortgage Guidelines

Mortgage Qualification Calculator Spreadsheet

Tearing Up Cfpb S Mortgage Underwriting Rule Is The Easy Part American Banker

When Should I Use Regression Analysis Statistics By Jim

Fha Mortgage Qualification Calculator Freeandclear